COMMERCIAL LENDING NEWSLETTER

You are receiving this letter because you are one of my Spartans - my top-producing brokers and investor clients - of whom I am allowed to have 300. Removal instructions are below. Today we'll talk about the drawbacks of securitized commercial loans. We also have lots of cute, clean jokes, some funny pics, and a pretty funny Christmas video.

Joke Du Jour

Tired of being broke and stuck in an unhappy marriage, a young husband decides to solve both problems by taking out a large insurance policy on his wife, with himself as beneficiary, and arranging to have her killed. A "friend of a friend" put him in touch with a nefarious underworld figure who went by the name of "Artie."

Artie explained to the husband that his going price for snuffing out a spouse was $5,000. The husband said he was willing to pay that amount, but he wouldn't have any cash on hand until he could collect his wife's insurance money. Artie insisted on being paid something up front. The man opened up his wallet, displaying a single dollar bill that rested inside. Artie sighed, rolled his eyes, and reluctantly agreed to accept the dollar as down payment for the dirty deed.

A few days later, Artie followed the man's wife into the local Safeway grocery store. There he surprised her in the produce department and proceeded to strangle her with his gloved hands. As the poor unsuspecting woman drew her last breath and slumped to the floor, the manager of the produce department stumbled onto the scene. Unwilling to leave any witnesses behind, Artie had no choice but to strangle the produce manager as well.

Unknown to Artie, the entire proceedings was captured by hidden cameras and observed by the store's security guard, who immediately called the police. Artie was caught and arrested before he could leave the store. Under intense questioning at the police station, Artie revealed the sordid plan, including his financial arrangements with the hapless husband.

And that is why the next day in the newspaper, the headlines declared, "ARTIE CHOKES TWO FOR A DOLLAR AT SAFEWAY."

Obama Plays Golf

Private Money Commercial Loans Nationwide From $100,000 to $3.5MM

Is your client's commercial property partially vacant? Do you need a lender who will allow the seller to carry back a second mortgage? Does your client have a balloon payment coming due on his commercial property? Has your bank offered him a discounted pay-off? Does your borrower have less-than-stellar credit? Is your client's company losing money? Is your borrower a foreign national? Do you need a non-recourse loan? We make slightly scratched-and-dented commercial loans.

Our hot, new product is a blanket loan against a portfolio of rental homes. Rental homes? Yup, as long as there are at least five homes or units, we consider this to be a commercial loan. We even offer a partial release clause. This loan is ideal for speculators.

And don't forget, we will quickly and happily issue you a written Loan Approval Letter - at no charge - that you can use as a fallback and to lure cheaper lenders. After all, everyone wants to lend to you if you already have a commitment. Here is our latest rate sheet.

Blackburne & Sons is looking for commercial real estate loans that are not quite clean enough for a bank. Please click here to submit a hard money commercial loan or call me, Tom Blackburne, at (574) 210-6686.

Trump Joke I

"At a Donald Trump rally the other night, a supporter shouted out the Nazi salute 'Sieg Heil!' Trump immediately responded, "There is no place for that here — save it for my inauguration." -- Conan O'Brien

(I know, mildly funny but kind of disturbing too, huh?)

The Problem With Securitized Commercial Loans

Securitized commercial loans include the CMBS loans being made by conduits, the subprime commercial loans made by Bayview Financial in the early 2000's, and the non-prime commercial loans being made by Velocity and Cherrywood today. The good news is that these securitized commercial loans have very low interest rates and very low monthly payments.

The problem with securitized commercial loans is that they burden the borrower's commercial property for ten years - making the property difficult to sell and economically impossible to refinance.

Here's why: The buyers of commercial mortgage-backed bonds are insistent that these bonds be a fixed rate. The reason why is because life insurance companies and defined benefit pension plans need to know exactly what they are going to earn, so they can be sure that they have enough dough to meet their actuarial projections (a certain number of people die or retire).

Therefore securitized commercial loans have enormous prepayment penalties (sometimes almost impossible to believe). To make matters worse, they all prohibit junior financing. Let's suppose a borrower accepts a $6.8 million securitized commercial loan on a $10 million building. Six years later, the building is worth $13 million. Did you know that a prospective buyer would have to put $6.2MM (48%) down! Or the seller could pay a $1.2 million defeasance prepayment penalty. Either way - yikes! Bank loans - or even private money loans with no prepayment penalty - are much better. The property owner is not tied to a chair.

Need a commercial loan from a bank, a conduit, a life company, a non-prime commercial lender, or a hard money lender? Simply complete this super-easy mini-app.

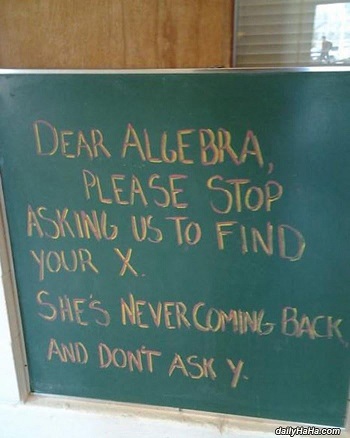

You Need To Move On

Trump Joke II

"After protesters interrupted a Donald Trump rally last night, some attendees were heard yelling the Nazi salute 'Sieg heil.' Which is alarming, but it doesn't mean that Donald Trump is the same as Hitler. It just means that if you looked up Hitler on Amazon, Trump might show up in the 'You may also like' section." -- Seth Meyers

(Demagogue,n: A political leader who seeks support by appealing to popular desires and prejudices, rather than by using rational argument.)

Sweet Apartment Loan Program for "A" Deals

Blackburne & Sons has a terrific apartment loan program for "A" quality deals. Our fixed rate is adjusted according to the desirability of the property and the area, but it starts at 3.87% and 1 point for a 30-year fully-amortized loan. For more details, please call Tom Blackburne at (574) 210-6686.

Snowman Joke

Q: What did one snowman say to the other snowman?

A: Do you smell carrots?

Small Balance Preferred Equity ($100K to $1MM)

If an investor wants to buy a leased commercial property, banks today will seldom lend more 58% to 62% LTV. Your buyer only wants to put down 25% of the purchase price

Quick, easy preferred equity from Blackburne & Sons fills in the missing piece of the capital stack. We'll add our $150,000 in equity dollars to your client's $250,000 down payment to create a down payment large enough to satisfy the bank. Think of our preferred equity as tiny Joint Venture investments.

For more information, please call Tom Blackburne at (574) 210-6686.

You Gotta Admit

Cow Joke

Q: Why did the cow jump over the moon?

A: Because the farmer had cold hands.

Too Busy to Broker Commercial Loans to Us? Why Not Just Refer Them Instead? We Make It Easy!

We once paid a $21,250 referral fee. Here is our referral fee program.

Short Christmas Video

Pretty funny.

On a Personal Note

My girlfriend and I spent Christmas day together, by our selves. It was not intentional, but just how the hectic holiday schedule worked out. We were debating what to do and ultimately decided to go on a picnic (yes, in December!) in the woods. We brought only a blanket, lighter, Wheat-thins, 2 paper cups, 1 bottle opener, and a single bottle of wine. This might have been the best Christmas I’ve ever had. The only mistake was that we only brought 1 bottle of wine! In hindsight, we really could have used some napkins, too...

Don't Forget About C-Loans.com

We have a whole new crop of hungry commercial lenders on C-Loans, so if you have a commercial loan you're trying to place, it takes just four minutes to submit your deal to 750 commercial lenders. And remember, C-Loans.com is free!

Final Funny

During the Super Bowl, there was another football game of note between the big animals and the little animals. The big animals were crushing the little animals, and, at half-time, the coach made a passionate speech to rally the little animals.

At the start of the second half the big animals had the ball. The first play, the elephant got stopped for no gain. The second play, the rhino was stopped for no gain. On third down, the hippo was thrown for a 5 yard loss. The defense huddled around the coach, and he asked excitedly, "Who stopped the elephant?" "I did," said the centipede. "Who stopped the rhino?" "Uh, that was me too," said the centipede. "And how about the hippo? Who hit him for a 5 yard loss?" "Well, that was me as well," said the centipede.

"So where were you during the first half?" demanded the coach. "Well," said the centipede, "I was getting my ankles taped."

Get a Free E-Book on CREF

This free e-book contains seven of George's best blog articles on the subject of commercial real estate finance.

Contact Information

Tom Blackburne

BRE# - 01919403

NMLS# - 1014118

BLACKBURNE & SONS REALTY CAPITAL CORPORATION

4811 Chippendale Drive, Suite 101

Sacramento, CA 95841

Phone: (574) 210-6686

Fax: (916) 338-2328

Email: tommy@blackburne.com

|